Note: While this blog post was originally published in October 2020, we can still help you utilize tax strategies to help with your projects in 2021 and beyond.

2020 has been a rough year for so many of us in so many ways. Looking at just the business landscape in the COVID-19 era, it seems like a long time now since everything has been “normal.” So many things have changed, and the energy business has not been immune to this.

Many energy upgrade projects have been put on hold as building owners are holding on to their cash through the pandemic, and many are waiting until the economy stabilizes. However, there are some strategies that can be implemented right now to get back on track.

If you want to upgrade your lighting, and you want to qualify for a 2020 tax deduction, it’s not too late – but you should act quickly! As long as your project is completed by midnight on Dec. 31, 2020, you could still qualify for a 2020 tax deduction.

To stimulate economic recovery, the Tax Cut Jobs Act was recently updated to allow more tax deductions from LED lighting upgrades. We can help you take advantage of this. Combined with the energy and maintenance savings from an efficient LED lighting upgrade, our tax strategies can help you off-set the initial project costs by an average of 90 percent in the first year!

Further, under the CARES Act passed earlier this year, you can immediately expense a current-year capital investment in an LED lighting upgrade. If you combine this with other strategies our tax experts utilize, you could qualify for enough deductions to recover up to 110 percent of your capital investment in the same year the investment is made. This results in the shortest possible payback.

Important note: if you have any questions about our tax strategies, and whether or not you could be eligible, feel free to contact us.

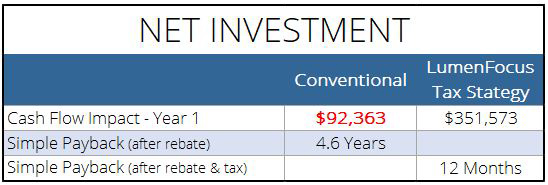

Below is a real-life scenario with a customer who implemented our tax strategies. With this project, you see the only change in the investment is the addition of the Tax Incentive Fees for utilizing the services of our team of tax experts. However, the customer received an estimated $480,104 in tax benefits for the upgrade.

This benefit provides a drastic advantage for year-one cash flow. This customer saw a simple payback in one year compared to 4.6 years using a conventional method.

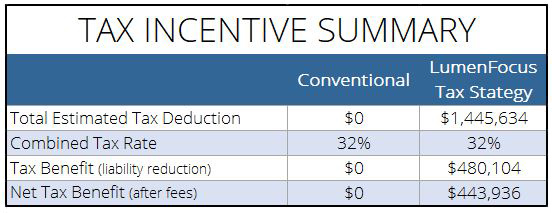

Below is a summary of the tax incentives for this particular project (note: the estimate of tax benefit here assumes the end user will file their taxes one year after the job is completed, and the “Tax Benefit” is the amount of the current-year tax liability reduction).*

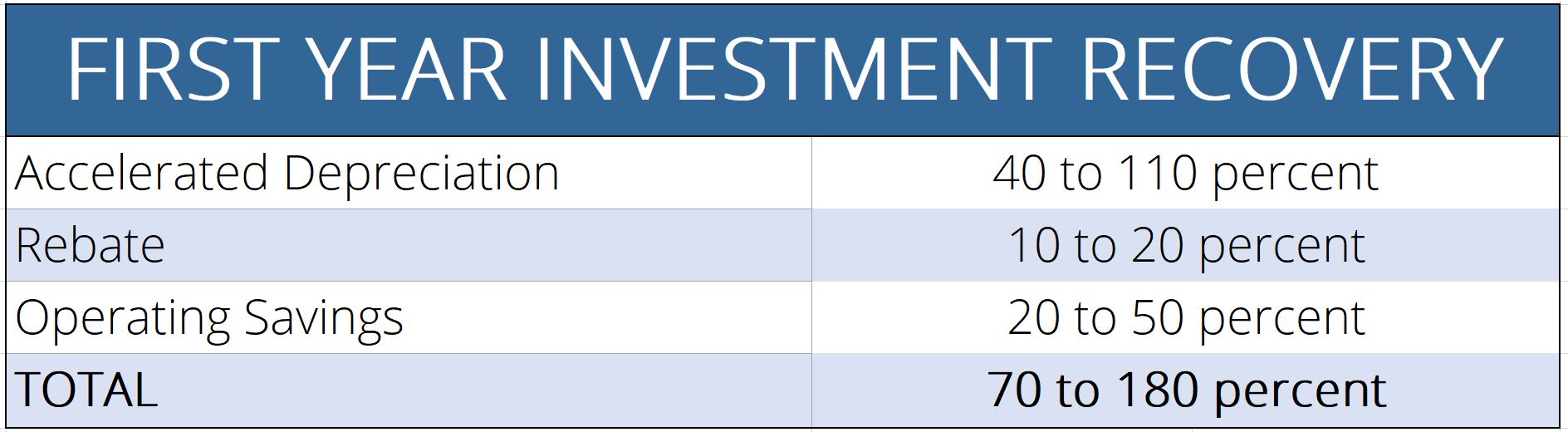

How do we do this? Our team utilizes four possible options to fund your lighting upgrade: accelerated depreciation, rebates, operating savings and custom financing. Below is a general rule-of-thumb for how much we can use these options to recover your investment in the first year.

- Accelerated depreciation: You can retire and write off existing obsolete lighting equipment. You can write of all, or part of your new energy efficient LED fixtures. You can also utilize accelerated depreciation on some of the remaining fixed building assets.

- Rebate: Cash paid to the utility customer for installing energy efficient fixtures.

- Operating savings: Repeatable bottom-line cash flow improvements that reduce avoidable burdens on profits from using old, energy inefficient light fixtures. New LumenFocus products provide a reduction in power demands and a reduction in on-going maintenance costs compared to fluorescent or HID fixtures.

- Custom financing: A financing option designed to generate immediate positive cash flow using monthly operating cost savings in lieu of up-front, out-of-pocket cash (capital lease or optional deferred payment plan).

So what tax services can LumenFocus provide to help you receive a deduction? There are four possible tax deductions that can be triggered by an LED lighting upgrade: EPAct (Energy Policy Act of 2005), abandonment, bonus depreciation and QIP, and accelerated depreciation. We can help you take advantage of these to determine the quickest way to recover and generate cash flow. If you’d like further information on each of these types of deductions, feel free to contact us.

*Note: This is a sample scenario, values are just estimates. The actual tax benefit and fees for your situation may differ, and they are subject to review of the end-user’s current tax depreciation schedule, and depends on the facts and circumstances regarding the depreciation treatment of real property.

Click here for an estimate of tax benefits request form. Results contained in this report are estimates. Actual benefits can be provided upon completion of an asset audit of your facility and review of your asset tax records by our professional engineers and forensic CPAs. Also, entering your luminaires under the “Existing Lighting” or “New Lighting” tab is not required, but will allow for a more accurate assessment.

For more information on our tax services, or for any questions, email Frank Austin here.

For more information on our tax services, or for any questions, email Frank Austin here.

Let us put our tax-centric strategy to work for you today!